Federal Reserve Chair Jerome Powell tempered market expectations for a rate cut yesterday, emphasizing the need for greater confidence in hitting inflation targets. He stated, “I don’t think it’s likely that we’ll reach a level of confidence by the time of the March meeting.” Initially, the market was evenly split on the chance of a March rate cut, but now it’s seen at just 35%. Despite this, financial markets still anticipate a significant 150 basis points rate cut this year.

image1.png

The Fed’s reliance on data was underscored, making Friday’s US Jobs Report (NFPs) particularly crucial, especially after the disappointing US ADP Report yesterday. Nonfarm payrolls are projected to reveal 180k new jobs added in January, down from 216k in December, while the unemployment rate is expected to rise to 3.8% from 3.7%.

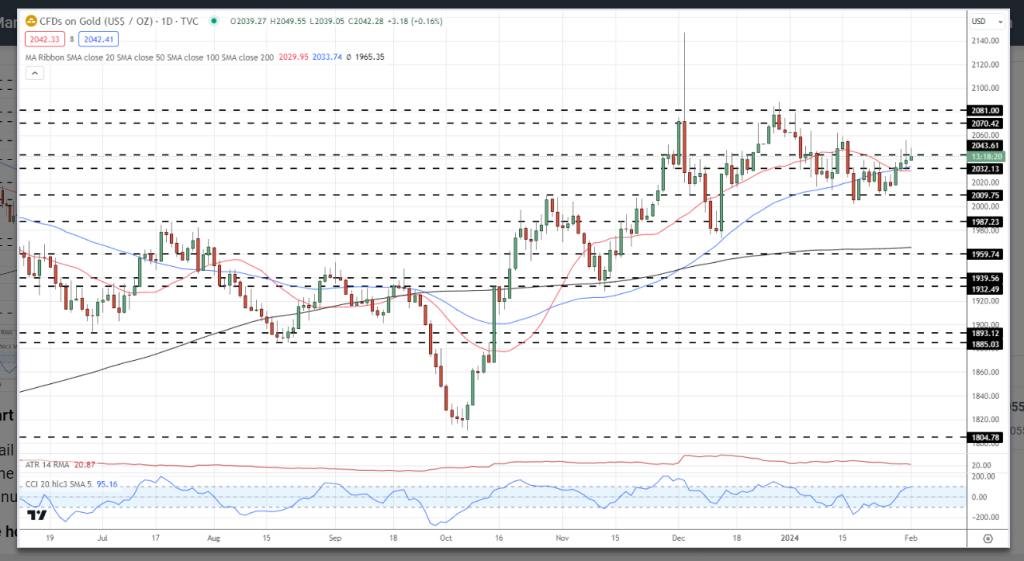

Gold, after hitting a multi-week low of $2,002/oz. in mid-January, has shown a steady performance, albeit without fireworks. Reaching a pre-FOMC high of $2,056/oz. yesterday, it then settled around $2,042/oz. Gold has recorded six consecutive higher lows and is back above all three simple moving averages for the first time in a month. The CCI indicator suggests gold is heading towards overbought territory. Initial support lies at $2,032/oz., followed by $2,010/oz. and $2,002/oz. A breach above Wednesday’s high could see gold bulls targeting $2,088/oz. in the short term.

Chart via TradingView

Retail trader data indicates that 58.92% of traders are net-long, with the ratio of long to short traders at 1.43 to 1. The number of net-long traders decreased by 9.22% compared to yesterday and by 15.32% compared to last week. Conversely, the number of net-short traders increased by 5.16% compared to yesterday and by 7.10% compared to last week.

Understanding the daily and weekly changes in IG Retail Trader data can provide insights into sentiment and potential price movements.