Meta’s stock price has reached a historic high ahead of its upcoming earnings report, driven by an increase in active users and advertising revenues.

Meta platformsSource: Bloomberg

When is Meta’s earnings date?

Meta is set to report its fourth-quarter (Q4) earnings on 1 February, with analysts expecting $4.95 in earnings per share (EPS) and $39 billion in revenue.

How has Meta performed?

In 2023, Meta experienced an astounding 194% surge in its stock price, reflecting its strong performance across key metrics like user growth, engagement, and monetization. The company’s efficient operation contributed significantly to this impressive growth.

The surge in Meta’s stock price is largely attributed to its remarkable improvements in user engagement. The platforms have witnessed a consistent rise in active users, providing advertisers with a broader audience to target. This growth underscores Meta’s commitment to innovation and adaptability in the dynamic social media landscape.

Additionally, Meta’s monetization strategies, particularly its focus on Reels, a short-form video feature, have been highly successful. Reels has not only captured user attention but also attracted advertisers, creating a new revenue stream for Meta. This innovation is expected to positively impact advertising revenue, especially after recent quarters of neutral or negative impacts.

Investments in data analytics, campaign planning, and AI-powered measurement tools have further bolstered Meta’s success. These advanced tools empower advertisers to optimize their campaigns effectively, ensuring higher returns on investment.

While Meta’s performance has been robust, it’s essential to consider broader economic factors. Forecasts indicate a potential deceleration in revenue growth in 2024, as the shift from traditional to digital advertising nears completion. Moreover, projections of a slowdown in U.S. economic growth could affect advertising budgets and, consequently, Meta’s revenue.

Operationally, Meta has signaled a slowdown in hiring, aiming to enhance efficiency and productivity among its existing workforce rather than expanding headcount significantly.

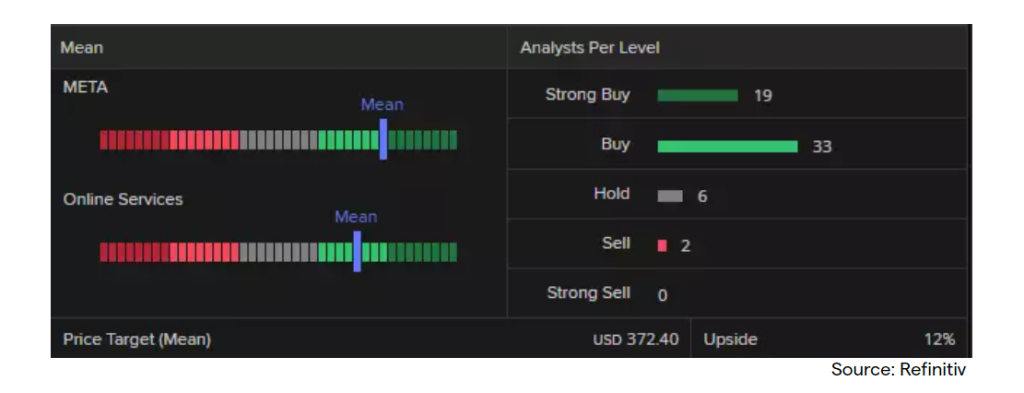

Analyst ratings for Meta

Refinitiv data reveals a consensus analyst rating of ‘buy’ for Meta, with a mean price target of $372.40. However, traders should exercise caution and consider various factors, including economic trends and operational decisions.

Technical outlook on the Meta share price

Meta’s share price is poised to reach a new all-time high, with a potential breach of its previous peak at $384.33. A sustained rise above this level could signal further gains, with the $400 mark becoming a significant psychological milestone.

Meta’s share price remains bullish, supported by its upward trend line and recent reaction lows. The stock’s recent gap higher indicates strong buying pressure, reinforcing its positive outlook in the medium term.

While challenges lie ahead, Meta’s strong performance and strategic initiatives position it well for future growth and continued success.