The Federal Reserve concluded its initial monetary policy meeting for 2024, opting to maintain its benchmark interest rate within the current range of 5.25% to 5.50%, as widely anticipated.

Nearly two years ago, the Fed embarked on an aggressive tightening cycle to combat surging inflation, implementing a series of rate hikes totaling 525 basis points. However, in the last four meetings, the Fed has held rates steady amid easing inflationary pressures.

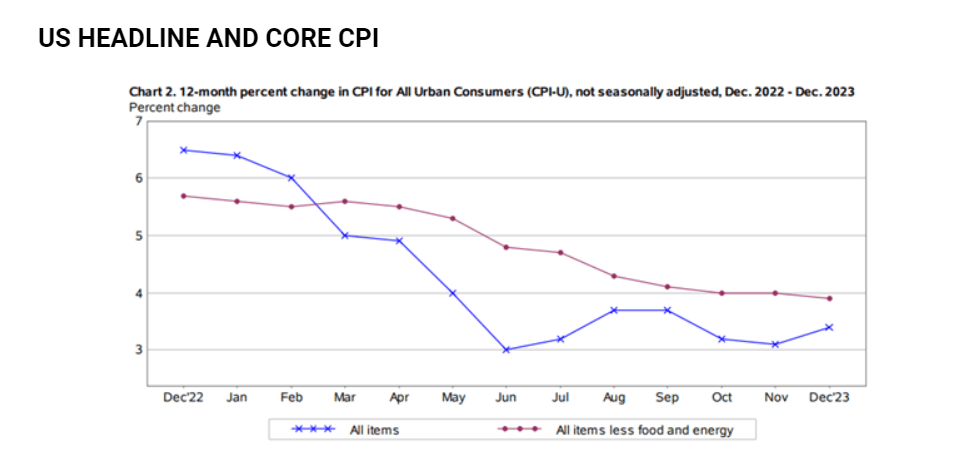

In 2022, headline CPI soared above 9% year-on-year before witnessing a significant decline, registering at 3.4% year-on-year last month. Although inflation remains above the 2% target, the Fed’s cautious stance reflects the evolving risks.

Analyzing the FOMC statement, the Fed painted a positive picture of the economy, acknowledging robust economic expansion and sustained employment gains despite some moderation.

Regarding inflation, policymakers reiterated that while inflationary pressures have eased over the past year, they continue to persist at elevated levels.

In terms of forward guidance, the Fed adopted a slightly dovish tone, abandoning its tightening bias in favor of a more neutral stance. The central bank acknowledged that risks to achieving employment and inflation goals are becoming more balanced.

However, the Fed signaled that it does not anticipate reducing borrowing costs until it has greater confidence in inflation moving toward the 2% target. This suggests that the Fed may not be ready to adjust its stance at the upcoming March meeting.

Following the FOMC announcement, gold prices retraced some early gains as Treasury yields and the US dollar attempted a rebound. All eyes are now on Fed Chair Powell’s press conference for further insights into monetary policy direction.