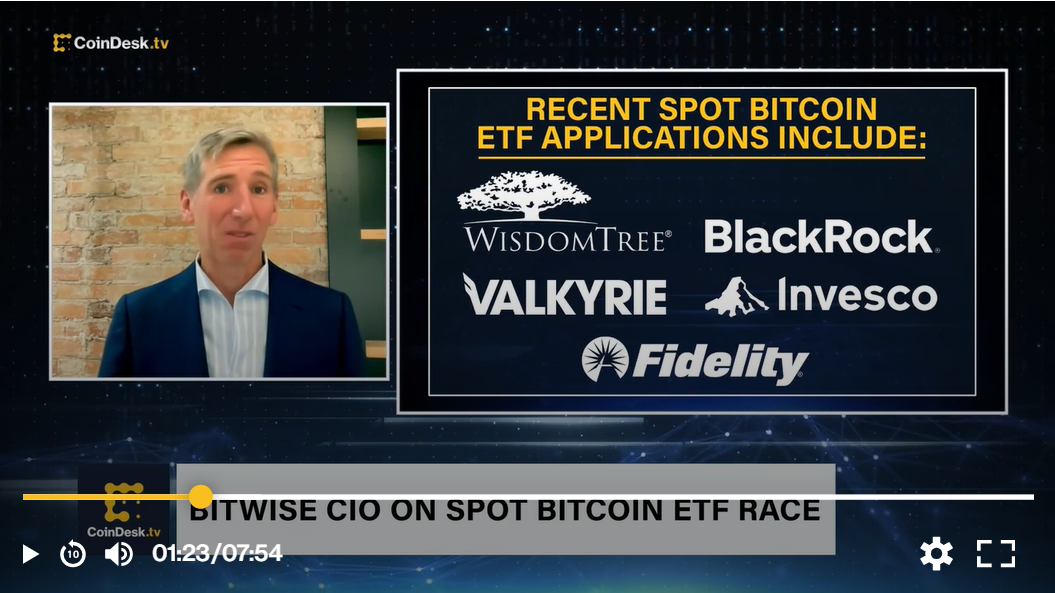

The U.S. Securities and Exchange Commission (SEC) has embarked on an extensive review process of the latest bitcoin exchange-traded fund (ETF) applications. This move follows the publication of documents seeking public consultations, with the official review set to commence upon the filings’ publication in the federal register. The SEC has solicited comments on multiple ETF applications, including those submitted by Cboe’s Wise Origin, WisdomTree, VanEck, Invesco Galaxy, and ARK 21Shares. Additionally, the SEC has sought input on BlackRock’s iShares Bitcoin Trust, filed on the Nasdaq exchange. Notably, the inclusion of surveillance-sharing agreements in these applications has garnered attention due to its potential impact on regulatory approval and market integrity.

Surveillance-Sharing Agreements: Enhancing Market Oversight and Integrity

To safeguard against market manipulation within the cryptocurrency ecosystem, the SEC has mandated surveillance-sharing agreements in ETF applications. These agreements require crypto exchanges to share trading data, including personally identifiable information (PII), if any suspicious trading activity is detected. By establishing such agreements, regulators and ETF providers gain access to crucial data that allows them to monitor and investigate potential misconduct effectively. Unlike traditional surveillance-sharing arrangements, information-sharing agreements enable regulators to “pull” specific data from exchanges, ensuring a more targeted and efficient oversight mechanism.

Information-Sharing Agreements: Strengthening Regulatory Supervision

Information-sharing agreements, which go beyond surveillance-sharing arrangements, offer an additional layer of transparency and accountability. These agreements empower regulators and ETF providers to request specific trade and trader information, including PII, from exchanges. By creating a consolidated audit trail, information-sharing agreements enable regulators to conduct in-depth investigations, particularly regarding suspicious trading activities. However, it is vital to strike a balance between regulatory oversight and individual privacy, ensuring that requests for information are specific and justified, resembling subpoenas rather than indiscriminate fishing expeditions.

Implications for Regulatory Approval and Market Confidence

The inclusion of surveillance-sharing and information-sharing agreements in ETF filings marks a significant step forward in addressing concerns surrounding market manipulation, investor protection, and regulatory compliance. By aligning ETFs with regulated markets and embracing enhanced transparency measures, ETF providers aim to cultivate investor confidence and gain regulatory approval. These agreements demonstrate the industry’s commitment to responsible market practices and its recognition of the importance of regulatory oversight. The SEC’s endorsement of an ETF with comprehensive surveillance-sharing and information-sharing agreements would signal a milestone achievement, reinforcing the regulatory body’s dedication to fostering a robust and transparent ETF market.

The Evolving Role of ETFs in the Cryptocurrency Landscape

Bitcoin ETFs hold the potential to bridge the gap between traditional financial markets and the emerging crypto ecosystem, providing investors with regulated exposure to digital assets. While the SEC’s rigorous review process underscores the cautious approach to ETF approval, it also reflects the evolving regulatory landscape within the cryptocurrency industry. By incorporating mechanisms to prevent market manipulation and enhance transparency, ETF providers are positioning themselves as responsible market participants. The successful approval of ETFs with surveillance-sharing and information-sharing agreements could pave the way for increased institutional participation, bolster market liquidity, and contribute to the maturation of the cryptocurrency market.

Conclusion: Shaping the Future of Bitcoin ETFs

As the SEC conducts a comprehensive review of bitcoin ETF applications, market participants eagerly await the regulatory body’s decision and its potential implications for the cryptocurrency industry. The integration of surveillance-sharing and information-sharing agreements demonstrates a commitment to addressing market integrity concerns and promoting investor protection. These measures are essential in building trust and confidence among market participants and regulators alike. Ultimately, the SEC’s decision on ETF approval, particularly those with comprehensive oversight mechanisms, will shape the future landscape of bitcoin ETFs, paving the way for increased mainstream adoption and potentially unlocking new avenues of growth for the cryptocurrency market as a whole.

Comments are closed.