The Japanese yen seems to be extending its upward trajectory in the aftermath of a moderately hawkish Bank of Japan (BoJ) meeting held in January. While the BoJ opted to maintain the status quo on negative interest rates and yield curve control, BoJ Governor Kazuo Ueda expressed growing optimism about the prospects of achieving the 2% inflation target.

The meeting outcomes signaled a subtle shift in tone from the BoJ, with Governor Ueda highlighting a gradual increase in the likelihood of reaching the inflation target. This shift in sentiment has bolstered investor confidence in the yen’s outlook, contributing to its ongoing bullish momentum.

A constructed Japanese yen index, comprising an equal-weighted average of USD/JPY, GBP/JPY, EUR/JPY, and AUD/JPY, illustrates a steady uptrend in the yen’s value over the past few trading sessions.

Weekly chart analysis of USD/JPY revealed the formation of a hanging man candlestick pattern, suggesting a potential downside move in the currency pair. Subsequent price action in the current week has validated this pattern, with USD/JPY edging lower towards the 146.56 support level.

Meanwhile, the daily chart for USD/JPY indicates the breakdown of a bullish pennant pattern, signaling a shift in short-term momentum to the downside. This divergence between longer-term and shorter-term price dynamics underscores the importance of incorporating multi-timeframe analysis in trading strategies.

Currently, USD/JPY is testing key support levels around 146.50, with further downside potential towards the 145 level. Notably, the 200-day simple moving average (SMA) serves as a critical long-term support level, potentially acting as a barrier against further downside moves.

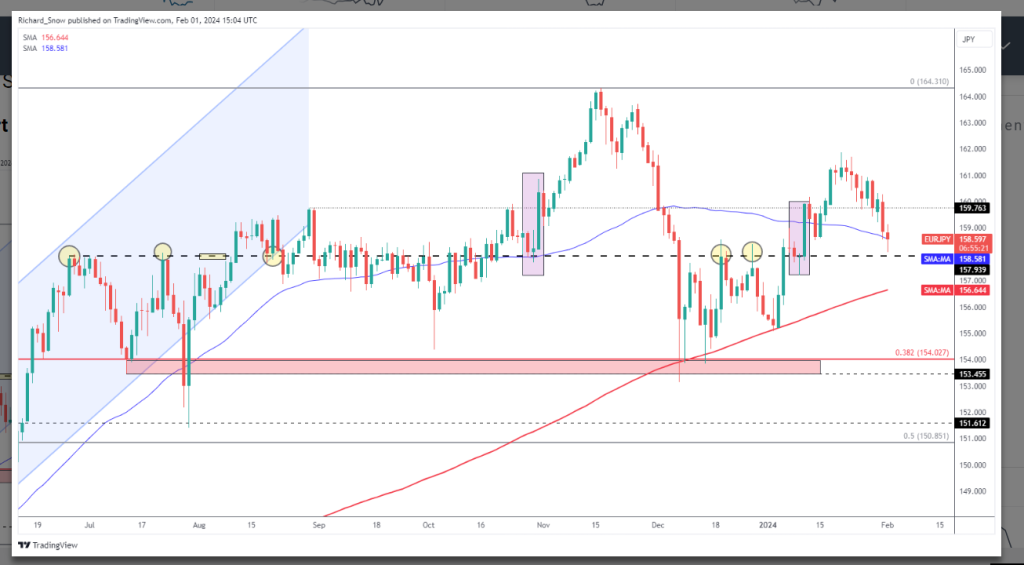

In the case of EUR/JPY, the currency pair has encountered resistance near the 50-day SMA and is approaching a significant pivot point at 157.94. This level has historically acted as a strong barrier to upside movements, posing a challenge for bullish momentum in the pair.

The recent downtrend in EUR/JPY has been characterized by bearish engulfing candlestick patterns, indicating increasing selling pressure. Should EUR/JPY breach the 157.94 resistance level, the 200 SMA at 156.64 stands as the next support level to watch, followed by 159.76.

Turning to GBP/JPY, the currency pair faces resistance around the 188.80 level, with a notable double top pattern potentially limiting further upside potential. Despite the Bank of England’s recent monetary policy update and updated forecasts, GBP/USD has exhibited minimal movement, suggesting a lack of bullish momentum.

As GBP/USD hovers near the 184.00 support level, traders are closely monitoring the MACD and RSI indicators for signs of further bearish momentum. A sustained breach below 184.00 could pave the way for a deeper pullback towards the 50-day SMA.

Overall, the Japanese yen’s recent strength reflects shifting market sentiment following the BoJ meeting, with traders adjusting their positions in response to evolving economic conditions and central bank guidance.

Disclaimer: The information provided in this content is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to engage in any specific trading strategy. Forex trading involves a significant risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Before engaging in forex trading, it is important to carefully consider your investment objectives, level of experience, and risk tolerance. You should seek independent financial advice if you have any doubts or concerns about the suitability of forex trading for your circumstances.

This Posts is Inspired by the provided article: Japanese Yen Provides Reversal Hints: USD/JPY, EUR/JPY, GBP/JPY Setups