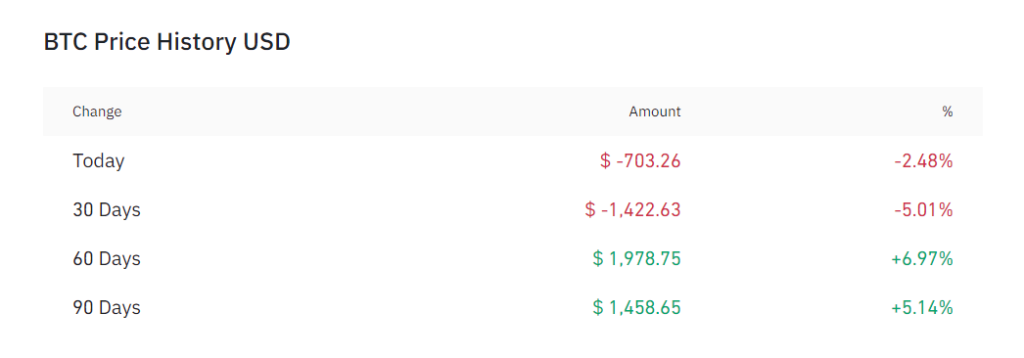

The cryptocurrency market experienced a notable decline as Bitcoin, the leading digital asset, faced selling pressure and dropped below the $28,000 mark on Thursday morning. This marked the first time in nearly two months that Bitcoin had fallen to such levels, continuing its downward trajectory for the week.

As the clock struck noon Eastern time, Bitcoin’s price plummeted to $27,705, a level not seen since late June. This downward movement represented a cumulative slide of almost 7% over the past seven days, amplifying concerns among traders and investors.

Ether, the second-largest cryptocurrency by market capitalization, was not immune to this trend, plunging to $1,724, which was also close to a two-month low. The broader CoinDesk Market Index (CMI) echoed this sentiment, reflecting a 4% decline early on Thursday afternoon. Within the CMI, every sector appeared to bear the brunt of this downward trend.

Swayed by Rising Interest Rates One of the primary factors contributing to the ongoing sell-off in the cryptocurrency market is the persistent surge in global interest rates. This is especially evident in the United States, where the 30-year Treasury bond rate climbed to 4.42%, marking its highest level since 2011. Additionally, the 10-year yield, now at 4.32, hovers just one basis point away from reaching a 15-year high.

The upward trajectory of interest rates has not only impacted the cryptocurrency market but has also affected risk assets across various financial markets. The Nasdaq, for instance, has witnessed a 6% drop over the course of August, signaling a broader shift in market sentiment towards caution and risk aversion.

Impact on Crypto and Investments The surge in bond yields has significant implications for both equities and non-yielding assets such as cryptocurrencies and gold. According to macro analyst Noelle Acheson, higher bond yields indicate a weaker investment case for equities. Tighter credit conditions can lead to lower growth, which, in turn, brings down cash flow valuations. This situation has resulted in the plummeting of the equity risk premium to levels not seen since 2007.

Furthermore, Acheson pointed out that higher bond yields also undermine the investment case for non-yielding assets like Bitcoin and gold. While the fundamental value of hard assets remains strong, the allure of yield becomes a dominant factor in investment decisions, favoring traditional income-generating assets.

Uncertainty Around Bitcoin ETF Approval Despite the hopes of Bitcoin enthusiasts for the imminent approval of a spot Bitcoin ETF by the U.S. Securities and Exchange Commission (SEC), uncertainties loom over the outcome and timing of such a decision. The approval process for these applications is not guaranteed, and some analysts suggest that a decision might not even be reached by the end of 2023.

Another positive catalyst for the market could arise from a favorable court ruling regarding Grayscale’s lawsuit against the SEC. Grayscale, the entity behind the Grayscale Bitcoin Trust (GBTC), aims to convert its trust into an ETF. Although expectations of a Tuesday ruling were dashed, market participants are now looking toward Friday as a potential turning point.

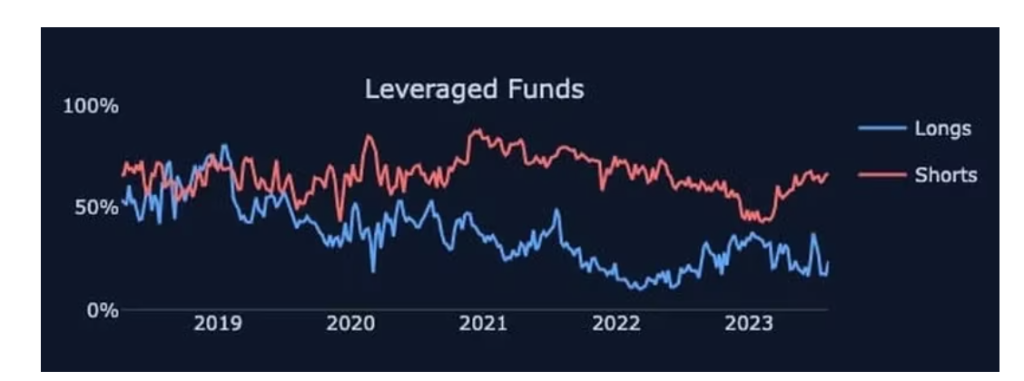

Bearish Sentiment in Leverage Funds Coinciding with Bitcoin’s recent bout of downside volatility, the U.S. Commodity and Futures Trading Commission (CFTC) reported that leveraged funds, including hedge funds and commodity trading advisors, have increased their bearish positions in CME-listed cash-settled Bitcoin futures. The most recent report on commitment of traders (COT) indicated that two-thirds of their positions are short, the highest ratio since April 2022.

This heightened bearish sentiment among sophisticated traders has been attributed to apprehensions stemming from the macroeconomic outlook and rising U.S. government bond yields. These concerns, combined with the crypto market’s indifference to positive developments like PayPal’s stablecoin launch and the influx of applications for ether-based futures-based ETFs, have contributed to declining volatility and volume metrics.

In conclusion, while positive trends and fundamentals continue to underpin optimism in the cryptocurrency market, it remains crucial to monitor potential spillover effects from the broader financial landscape. Bitcoin’s recent bout of downside volatility reflects a historical pattern of interim tops following significant rallies, mirroring the trajectory of meme coin SHIB. As the market navigates these dynamics, careful observation is necessary to gauge the evolving impact on crypto assets.

Moreover, the pullback of SHIB since its recent surge highlights the volatility inherent in the cryptocurrency space. The launch of Shibarium, a pivotal development for the SHIB ecosystem, has been accompanied by turbulence. Funding rates in SHIB perpetual futures trading on Binance exemplify this uncertainty, plummeting to a two-month low of -0.084%, signifying the challenges and uncertainties the crypto market currently faces.

- Read more: Shiba Inu’s Recent Downturn Amidst Positive On-Chain Metrics

- Read more: What is Shibarium