Market Update: Dow Jones, NASDAQ 100, and DAX Recover from Recent Lows

Published on July 29, 2024

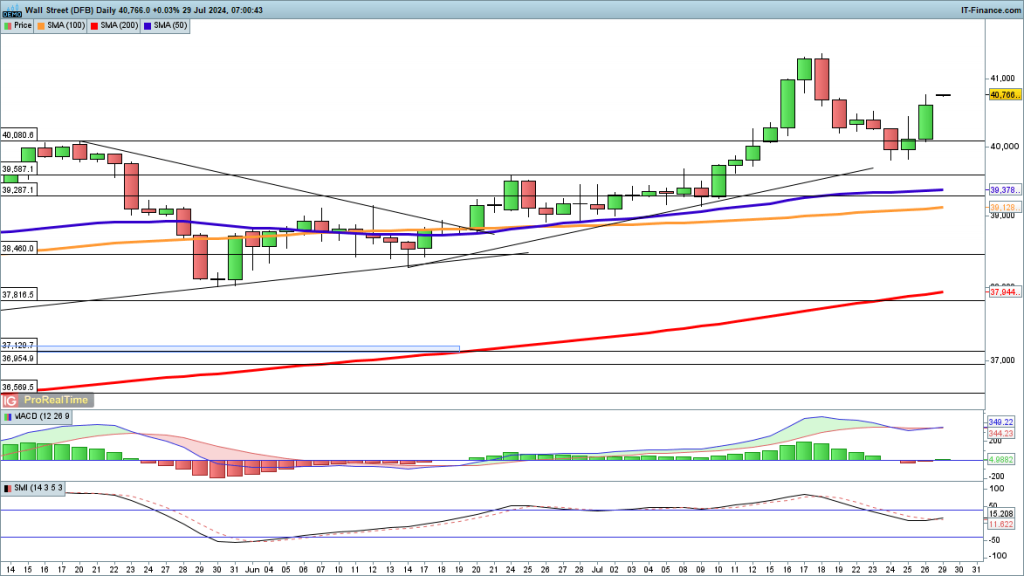

Dow Jones Index Stages Strong Recovery

Last week, the Dow Jones index experienced a robust rebound, surging back above the 40,000 mark after a pullback from its record high in July. As the new week begins, the index is once again on track to test the July peak at 41,390. If it surpasses this level, we could witness new record highs. However, a reversal below 40,000 would negate this bullish view1.

NASDAQ 100 Finds Support at Key Moving Average

The NASDAQ 100 faced selling pressure but managed to find support at the 100-day simple moving average (SMA) last week. It has since climbed back above 19,000. While several major tech companies are reporting this week, further upside progress may be challenging. Nonetheless, a potential low has formed for now. A close above the 50-day SMA would strengthen the bullish case, while sellers hope for a reversal below 18,800 to invalidate the higher low thesis1.

DAX 40 Index Holds Steady

Unlike its US counterparts, the DAX 40 index hasn’t seen a dramatic recovery, but it also avoided significant losses. The 100-day SMA has acted as trendline support since mid-June, preventing a firm close below it. On Friday, the DAX rebounded and is now poised to test previous resistance at 18,600. Beyond this lies the mid-July high at 18,786. Sellers remain watchful for a close below the 100-day SMA and a drop through 18,000, which would break the support zone of the past six weeks1.

In summary, indices have indeed bottomed out temporarily, with the Dow leading the charge towards recent highs. Keep an eye on these key levels as markets continue to navigate volatility and economic developments.